Gusto take home pay calculator

While take-home pay is net pay after taxes and other deductions gross pay is the total income an individual earns before taxes and deductions. Remember the price you pay varies widely depending on factors like weight package dimensions shipping time and distance shipped.

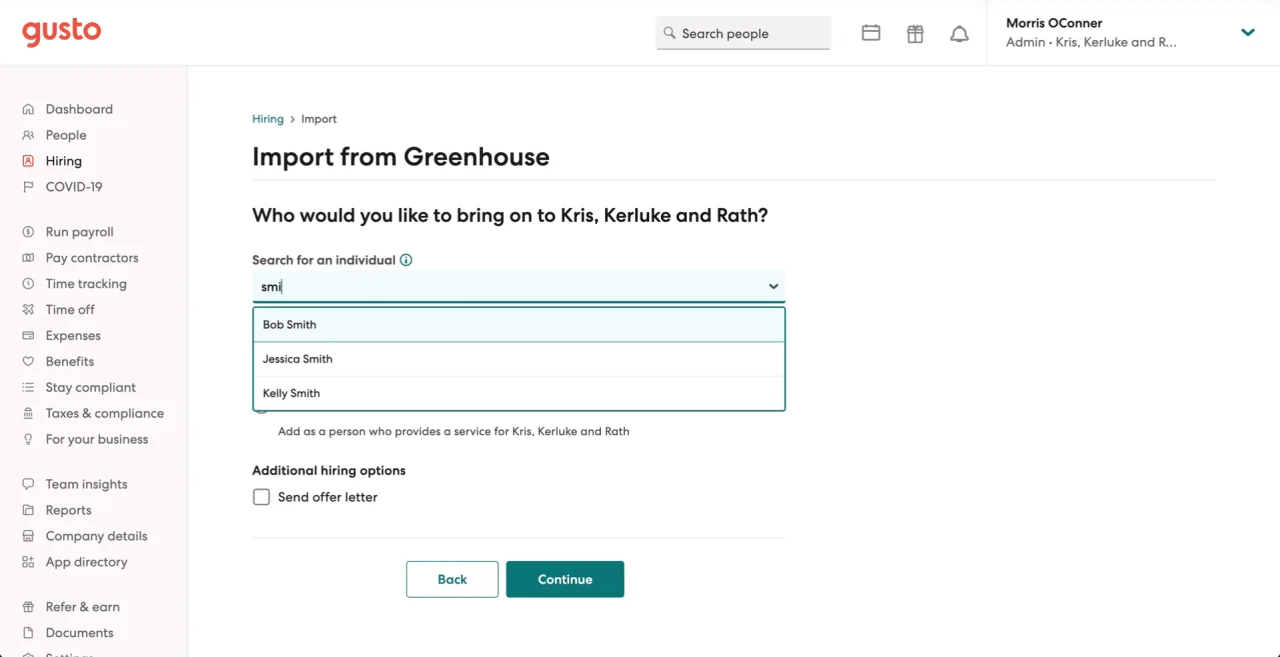

Gusto And Greenhouse

Switch to Florida hourly calculator.

. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. ASCII characters only characters found on a standard US keyboard. This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Switch to North Carolina hourly calculator.

At the end of the year we will supply a report with the details your accountant will need to claim this credit on your corporate tax returns. This Maryland hourly paycheck calculator is perfect for those who are paid on an hourly basis. This North Carolina hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Switch to North Carolina salary calculator. Switch to Montana hourly calculator. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck calculator.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Florida. Terra Madre Salone del Gusto is an international event dedicated to food politics sustainable agriculture and the environment. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

You need to be a full time undergraduate student on at least a 2-year course at a UK UniversityCollege or you need to be completing a full time postgraduate or nursing course lasting a year or more. Gusto at a glance Take care of your people. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Come to Parco Dora Turin from September 22-26 2022 to shape the future of food with us. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Your gross pay is 1600 20 x 80 hours. Youll get our great perks and benefits plus a WFH.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Cloud computing is the on-demand availability of computer system resources especially data storage cloud storage and computing power without direct active management by the user. Must contain at least 4 different symbols.

What is the take-home pay. 6 to 30 characters long. Switch to Nebraska hourly calculator.

Accepting online payment for your goods or services helps you reach a. Yes you can choose to have Gusto automatically adjust wages to comply with the FLSA Tip Credit and minimum wage adjustment requirement. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California.

Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Texas. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

Doing business online is pretty much a given for any company even if your primary product or service is purchased in person. To apply you must be 17 and a UK Citizen or have been living in the UK for at least 3 years. For example you make 20 per hour and work 80 hours per pay period.

Switch to Georgia hourly calculator. But we couldnt do it without ours. Calculate your Montana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Montana paycheck calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. If you work from home full-time you arent expected to come into the office. Large clouds often have functions distributed over multiple locations each location being a data centerCloud computing relies on sharing of resources to achieve coherence and typically.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Switch to Missouri salary calculator. Theyll take care of business.

Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska paycheck calculator. You can meet over 600 exhibitors in our market and take part in a series of workshops conferences and tastings. Associate membership to the IDM is for up-and-coming researchers fully committed to conducting their research in the IDM who fulfil certain criteria for 3-year terms which are renewable.

Switch to Maryland salary calculator. In that case read on. So unless you happen to live in Tennessee and do a lot of shipping to Wyoming the examples above wont actually satisfy your need to know exactly you can expect to pay for shipping.

Weve helped more than 200000 businesses onboard pay and support their teams. Gusto can also help restaurants claim the FICA tip credit tax incentive. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

To get take-home pay you must subtract taxes and deductions. Calculate your Florida net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Florida paycheck calculator.

Gusto And Greenhouse

Amazon Com Calculator Green Basic Small Solar And Battery Operated Large Display Four Function Auto Powered Handheld Calculator School And Kids Available In Blue Red Purple Grey Pink 240 Pk By

What Is Casdi Employer Guide To California State Disability Insurance Gusto

9 Best Payroll Services For Small Business September 2022 Forbes Advisor

Payroll Tax Calculator For Employers Gusto

15 Best Payroll Services In 2021

Gusto And Greenhouse

Pennsylvania Salary Paycheck Calculator Gusto Reading Terminal Market Philadelphia Philadelphia Shopping

11 Best Online Payroll Services Companies 2022 Reviews

Gusto Careers Comparably

Gusto And Greenhouse

Payroll Tax Calculator For Employers Gusto

Gusto And Greenhouse

Guide To The Second Draw Ppp Loan Application Gusto

Gusto And Greenhouse

Mississippi Salary Paycheck Calculator Paycheckcity

Top Gusto Competitors Alternatives In 2022 Forbes Advisor